When we went deeper into the latest inflation figures, we realized that the Prices have increased by a staggering 8.5 percent from a year ago. They increased by 1.2 percent in March alone. This is the largest gain in a single month in the last six months. And, if you look at the trend over the last year, those monthly gains have been increasing rather than decreasing.

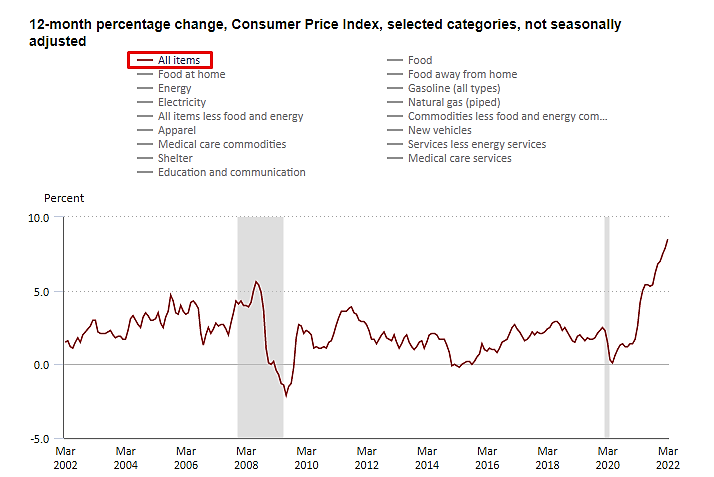

That’s not all, though. There’s very much nowhere to hide if you walk down the individual components of the price rises. Food is up 9% year over year, used cars and trucks are up 35%, gas is up 48%, and oil is up a mind-boggling 70%. In the chart below, you’ll find the facts:

Top-line inflation is at multi-year highs, as this figure shows. In fact, March’s 8.5 percent increase over the previous year was the largest 12-month increase since December 1981.

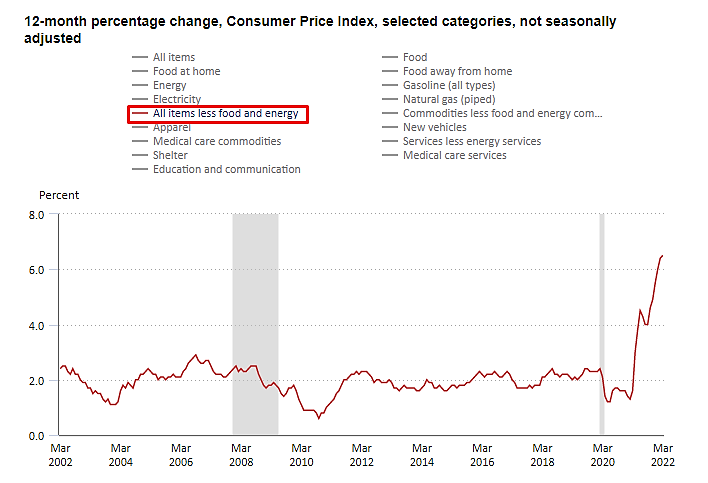

Take a look at the same graph, but without the more variable food and energy components:

Core inflation is also on the rise, rising 6.5 percent from a year earlier, as shown in this graph. This graph is considerably more concerning. This is due to the fact that it measures “core” inflation, which excludes food and energy. Core inflation measures the prices of products that we don’t necessarily “need” by removing food and energy, two components we can’t live without. If they’re rising at the same time as food and energy, inflation has spread far and wide.

What is the Cause of Inflation?

So, what’s behind these huge price hikes? You can choose from a variety of options. Supply chain challenges caused by persisting covid issues are still the most serious problem. Why? Because as the number of cases of covid increases and manufacturers closes facilities, the production from such factories decreases the number of products available to buyers. Lower supply equals higher pricing, as we learned in Econ 101. One recent example is China’s recent ascent and lockdown.

Another important factor? A key driver is a pent-up demand from the two years of covid. There is still a lot of demand out there, and that want isn’t going to stop people from buying. People and corporations, on the other hand, are not turning off the buying spigot when they perceive increased prices. They simply pay up.

Not all of the news is negative. The Federal Reserve has already begun raising interest rates and intends to do so several times in the next year. The Fed makes borrowing more expensive for households and businesses by employing this monetary policy instrument. Why does this help to keep inflation down? Because rising interest rates imply higher borrowing costs. When consumers and businesses are forced to pay more for loans, they are more likely to put the brakes on borrowing money.

Another plus is that when you look at the core inflation rate on a monthly basis, you may see a favorable trend. For the month of March, it was.3 percent. This compares to.5 percent in February and.6 percent in January. In fact, the core rate in March was the lowest monthly rate since September last year. That is a positive step forward.

What Should You Do Right Now?

So, what are the options for investors right now? They should stick to: investing in companies that know what they’re doing in markets with high upside potential. Also, don’t get too worked up about daily stock price changes. Let management deal with it.

This comprises all of my assets, including equities, cryptocurrency, and other digital currencies. While geopolitical dynamics are undoubtedly at work right now, history has demonstrated that these geopolitical shocks have a limited long-term impact. They usually resolve themselves over time.

Inflation, on the other hand, has the potential to be more damaging. As a result, I keep a close eye on what the Fed is up to, particularly in the coming months. also keep track of both the top-line and the core inflation numbers. Let’s see if the core figure continues to fall month after month.

That said, if you’re looking for hedges against inflation, the old standbys are certainly available. That would include buying companies that are in non-cyclical markets, which are markets that make products that consumers and businesses need no matter what. That includes food, energy, utilities, some consumer products, and pharmaceuticals, among others. But keep in mind that with food and energy at nosebleed levels, you’ll likely be paying a premium for companies in those markets.

Gold is also a reliable option. It’s been behaving like a reliable risk-off asset since the beginning of the year. Indeed, since the beginning of the year, a chart of gold versus stocks reveals a strong negative association. That’s a strong argument for gold as a safe haven against stock market volatility. Keep in mind, however, that the association breaks off as you move further back in time. So, if you’re going to buy gold, go with caution.

Bitcoin is also on the table. But like I said last week, Bitcoin is still maturing as a store of value. So, while it behaves like gold under some time frames and is a decent hedge compared to stocks, sometimes it isn’t. You just have to keep an eye on it.